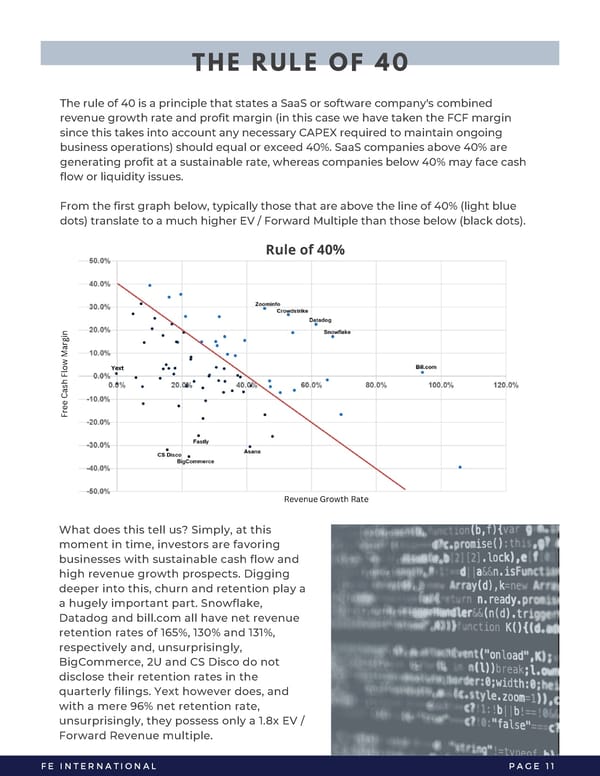

THE RULE OF 40 The rule of 40 is a principle that states a SaaS or software company's combined revenue growth rate and profit margin (in this case we have taken the FCF margin since this takes into account any necessary CAPEX required to maintain ongoing business operations) should equal or exceed 40%. SaaS companies above 40% are generating profit at a sustainable rate, whereas companies below 40% may face cash flow or liquidity issues. From the first graph below, typically those that are above the line of 40% (light blue dots) translate to a much higher EV / Forward Multiple than those below (black dots). Rule of 40% Yext Free Cash Flow Margin Revenue Growth Rate What does this tell us? Simply, at this moment in time, investors are favoring businesses with sustainable cash flow and high revenue growth prospects. Digging deeper into this, churn and retention play a a hugely important part. Snowflake, Datadog and bill.com all have net revenue retention rates of 165%, 130% and 131%, respectively and, unsurprisingly, BigCommerce, 2U and CS Disco do not disclose their retention rates in the quarterly filings. Yext however does, and with a mere 96% net retention rate, unsurprisingly, they possess only a 1.8x EV / Forward Revenue multiple. FE INTERNATIONAL PAGE 11

2023 M&A Report | SaaS Page 12 Page 14

2023 M&A Report | SaaS Page 12 Page 14