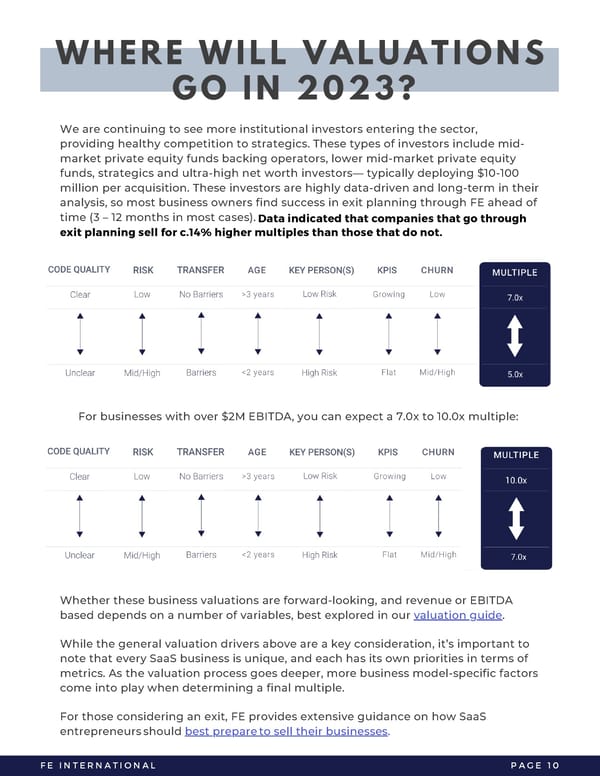

WHERE WILL VALUATIONS GO IN 2023? We are continuing to see more institutional investors entering the sector, providing healthy competition to strategics. These types of investors include mid- market private equity funds backing operators, lower mid-market private equity funds, strategics and ultra-high net worth investors— typically deploying $10-100 million per acquisition. These investors are highly data-driven and long-term in their analysis, so most business owners find success in exit planning through FE ahead of time (3 – 12 months in most cases). Data indicated that companies that go through exit planning sell for c.14% higher multiples than those that do not. For businesses with over $2M EBITDA, you can expect a 7.0x to 10.0x multiple: Whether these business valuations are forward-looking, and revenue or EBITDA based depends on a number of variables, best explored in our valuation guide. While the general valuation drivers above are a key consideration, it’s important to note that every SaaS business is unique, and each has its own priorities in terms of metrics. As the valuation process goes deeper, more business model-specific factors come into play when determining a final multiple. For those considering an exit, FE provides extensive guidance on how SaaS entrepreneurs should best prepare to sell their businesses. FE INTERNATIONAL PAGE 10

2023 M&A Report | SaaS Page 11 Page 13

2023 M&A Report | SaaS Page 11 Page 13