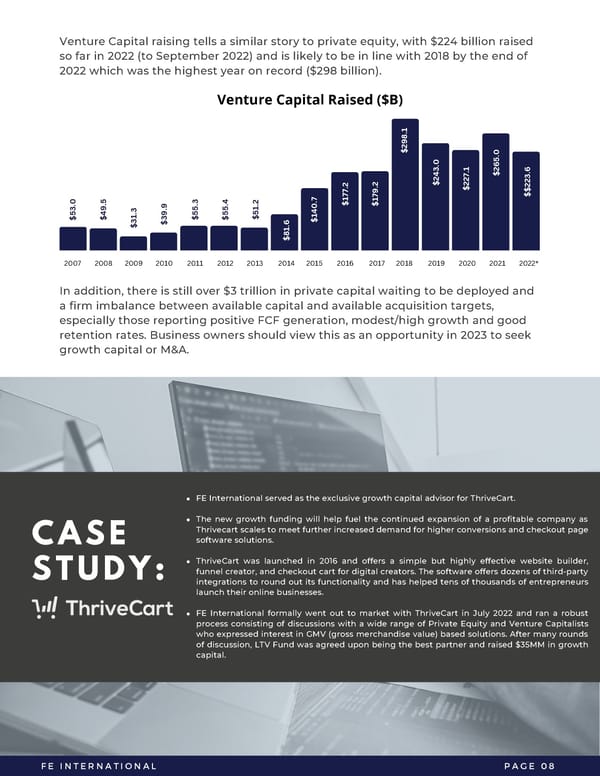

Venture Capital raising tells a similar story to private equity, with $224 billion raised so far in 2022 (to September 2022) and is likely to be in line with 2018 by the end of 2022 which was the highest year on record ($298 billion). Venture Capital Raised ($B) $298.1 $265.0 $243.0 $227.1 $$223.6 $177.2 $179.2 $51.2 $55.3 $55.4 $49.5 $53.0 $140.7 $39.9 $31.3 $81.6 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022* In addition, there is still over $3 trillion in private capital waiting to be deployed and a firm imbalance between available capital and available acquisition targets, especially those reporting positive FCF generation, modest/high growth and good retention rates. Business owners should view this as an opportunity in 2023 to seek growth capital or M&A. FE International served as the exclusive growth capital advisor for ThriveCart. The new growth funding will help fuel the continued expansion of a profitable company as Thrivecart scales to meet further increased demand for higher conversions and checkout page software solutions. CASE ThriveCart was launched in 2016 and offers a simple but highly effective website builder, funnel creator, and checkout cart for digital creators. The software offers dozens of third-party STUDY: integrations to round out its functionality and has helped tens of thousands of entrepreneurs launch their online businesses. FE International formally went out to market with ThriveCart in July 2022 and ran a robust process consisting of discussions with a wide range of Private Equity and Venture Capitalists who expressed interest in GMV (gross merchandise value) based solutions. After many rounds of discussion, LTV Fund was agreed upon being the best partner and raised $35MM in growth capital. FE INTERNATIONAL PAGE 08

2023 M&A Report | SaaS Page 9 Page 11

2023 M&A Report | SaaS Page 9 Page 11