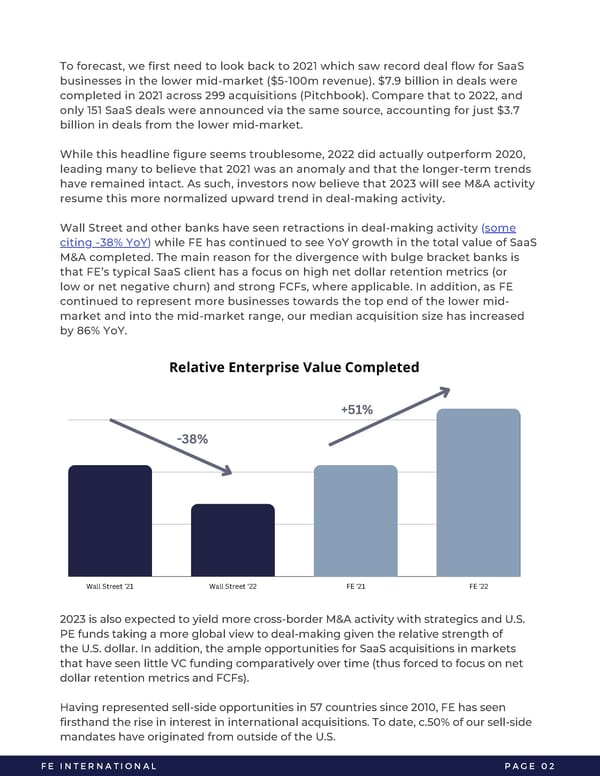

To forecast, we first need to look back to 2021 which saw record deal flow for SaaS businesses in the lower mid-market ($5-100m revenue). $7.9 billion in deals were completed in 2021 across 299 acquisitions (Pitchbook). Compare that to 2022, and only 151 SaaS deals were announced via the same source, accounting for just $3.7 billion in deals from the lower mid-market. While this headline figure seems troublesome, 2022 did actually outperform 2020, leading many to believe that 2021 was an anomaly and that the longer-term trends have remained intact. As such, investors now believe that 2023 will see M&A activity resume this more normalized upward trend in deal-making activity. Wall Street and other banks have seen retractions in deal-making activity (some citing -38% YoY) while FE has continued to see YoY growth in the total value of SaaS M&A completed. The main reason for the divergence with bulge bracket banks is that FE’s typical SaaS client has a focus on high net dollar retention metrics (or low or net negative churn) and strong FCFs, where applicable. In addition, as FE continued to represent more businesses towards the top end of the lower mid- market and into the mid-market range, our median acquisition size has increased by 86% YoY. Relative Enterprise Value Completed +51% -38% Wall Street '21 Wall Street '22 FE '21 FE '22 2023 is also expected to yield more cross-border M&A activity with strategics and U.S. PE funds taking a more global view to deal-making given the relative strength of the U.S. dollar. In addition, the ample opportunities for SaaS acquisitions in markets that have seen little VC funding comparatively over time (thus forced to focus on net dollar retention metrics and FCFs). Having represented sell-side opportunities in 57 countries since 2010, FE has seen firsthand the rise in interest in international acquisitions. To date, c.50% of our sell-side mandates have originated from outside of the U.S. FE INTERNATIONAL PAGE 02

2023 M&A Report | SaaS Page 3 Page 5

2023 M&A Report | SaaS Page 3 Page 5